Surveys in the work of a sales representative – 14 examples that will help you understand your sales

Surveys in the work of a sales representative are a powerful tool that can provide your company with a number of benefits.

Action is more effective when it is based on knowledge. This well-known fact begs the question: how and where do we get the knowledge we need to make decisions and take action? For more than 200 years, one of the most popular ways to gather and validate information has been through surveys. Surveys are a powerful tool that can bring a range of benefits to your business.

200 Years of Professional Surveys and IBM’s Success Story

The history of surveying is only a small part of the history of science (it has been used in research for about 200 years). However, it is a very interesting thread in which a company emerged that left its mark on global technology. We are talking about IBM, which set the pace not only for the development of survey research, but also for the computerisation of research and the digitisation of processes. You can find a nice article on this topic at this link.

Digital surveys as we know them today are the distant descendants of the punched cards that optimised census or market research (IMB punched cards). This brings us to the role of surveys in the work of a sales representative in gathering market information for sales directors, marketing directors and business analysts.

When you send sales reps out into the field, you most often assign them tasks related to… trade, of course. Order taking, price negotiations, discounts, promotions – these are the basics of field sales.

But Something Is Still Missing…

At the end of another quarter, when you’re tallying up the sales results, you can’t help but feel that the time spent could have been better spent. That sales targets, merchandising standards, promotional campaigns or marketing investments could have been achieved differently – in a smarter way.

Reflecting doesn’t always come at the right time, but there’s no better time to do it than here and now! I encourage you to consider what knowledge would help you better understand what is actually happening in your sales. What could help your salespeople, business partners and consumers better realise the potential of your products and services?

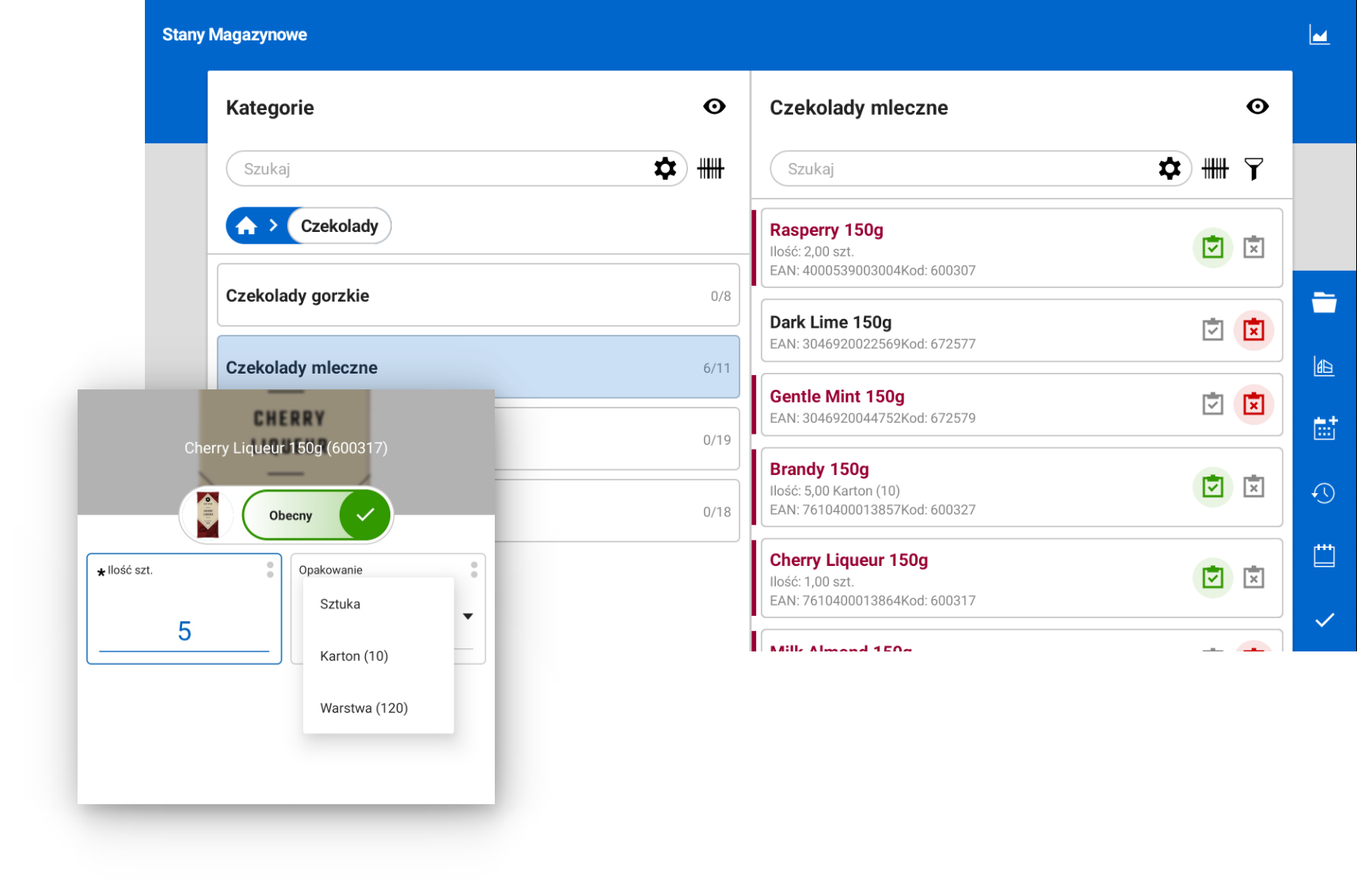

When looking for answers, do not rely on your intuition alone. Look around and ask those around you what you do not know. To encourage you, I am sending you a series of sample surveys that you can configure using the flexible and agile forms of a mobile field service app. It’s time to stop making assumptions and start working with real information. See how you can use surveys in the work of a sales rep.

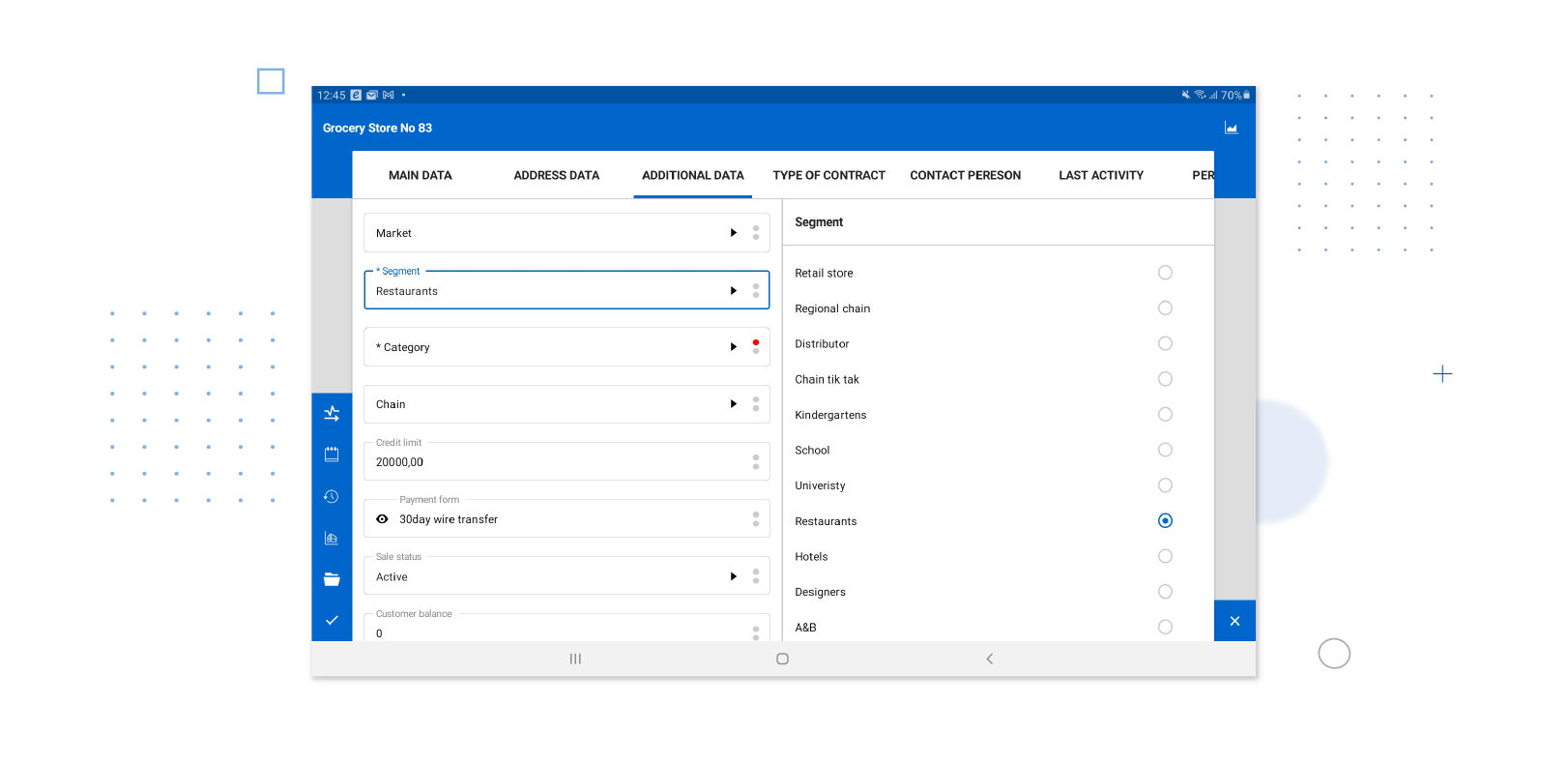

1. Point of Sale and Partner Data Update Survey

The relevance of data is a fundamental requirement for valuable sales analysis. It is therefore worthwhile to regularly collect and update information on where salespeople (or other field-based employees) are working. The dynamics of the market are well illustrated by the example of retail chains. Every day, stores appear and disappear. Some of them change their network affiliation, others change their product range strategy, stores lose and gain concessions, install self-checkout counters, remove refrigerators, and so on. Depending on which point of sale characteristics are important to your strategy, the survey should be designed accordingly, with responses feeding into the appropriate fields on customer cards in your CRM, ERP or SFA system. On the basis of up-to-date and organised data, it will be possible to segment the customers and to carry out more precise sales, prospecting or marketing activities.

2. Traditional Store Manager Satisfaction Survey

If sales automation is about saving time, what better way to spend that time than building positive relationships with customers? In the traditional channel, the relationship between the salesperson and the buying decision-maker still has a significant impact on how sales will go at a given point. Building a positive relationship with the store means getting information at the source. Satisfaction or evaluation surveys are a good way of getting first-hand knowledge of what stores think about your range, pricing, promotions, service standards or brand. The store is the voice of the consumer. So it pays to build surveys and ask rather than guess. The advantage of standardised data is that it can be added to the criteria needed for customer segmentation.

3. In-Store Network Standards Audit Survey

Stores that are part of a network, such as a franchise network, have set standards for part of the mandatory range, store signage, equipment, price labels, uniforms, additional services or cleanliness standards. Adherence to these standards varies, with some stores doing an excellent job, others not so good, and some not caring about such “details” as cleanliness of the premises or visual brand identification. Regional managers monitor standards through audit visits, ticking off a list of correct items and reporting non-compliance to head office. They also make recommendations on areas for improvement, for example. Audit questionnaires are often very extensive. When designing surveys, it is worth considering the consistency of the study and conducting it using tools that prevent accidental data loss and help maintain consistency of information to draw conclusions at a general level.

4. Mystery Shopper Survey

The most covert form of retail audit is the visit of a mystery shopper. The controller is in the store incognito, pretending to be a shopper or interested in the offer, and primarily checks the quality of customer service in the store, although he or she may also check other elements mentioned in the Audit Surveys section (especially product availability on shelves and out-of-stocks). The disadvantage of this approach is, of course, the inability to complete the survey in real time on a mobile device. Therefore, questionnaires for such studies should be designed in such a way that observations and responses to questions can be recalled from memory and reliably recorded after the visit.

5. Consumer Surveys

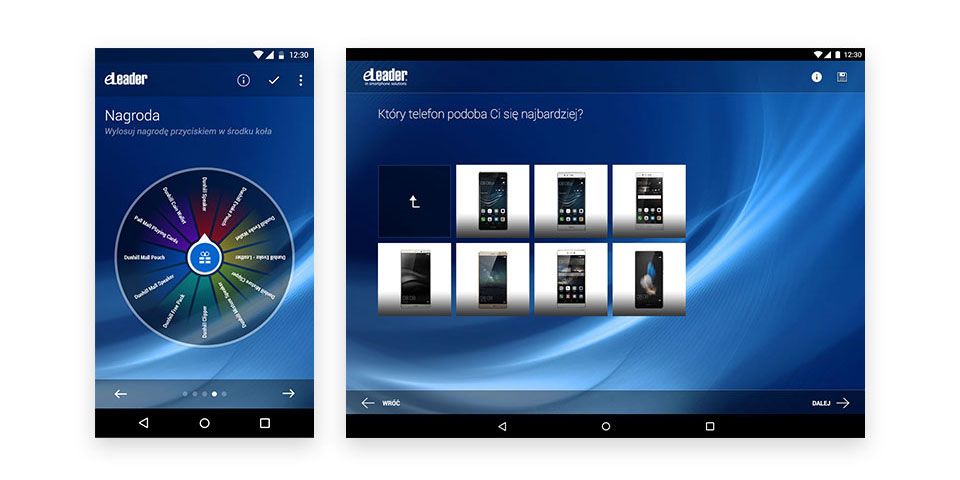

The ability to gather feedback on your brand and offering is one of the best ways to see your business through the eyes of your customers. This perspective increases the chances of improving your offer and your marketing. Consumer surveys are the easiest way to achieve this: If you want to know what your customers think, ask them.

Surveys used by manufacturers and distributors in the marketplace include product preference surveys, brand awareness surveys, satisfaction surveys, buying behaviour surveys and price preference surveys. An interesting option for such surveys is the ability to award and report the delivery of a gift to the respondent. An example could be a gamification option such as a lucky wheel.

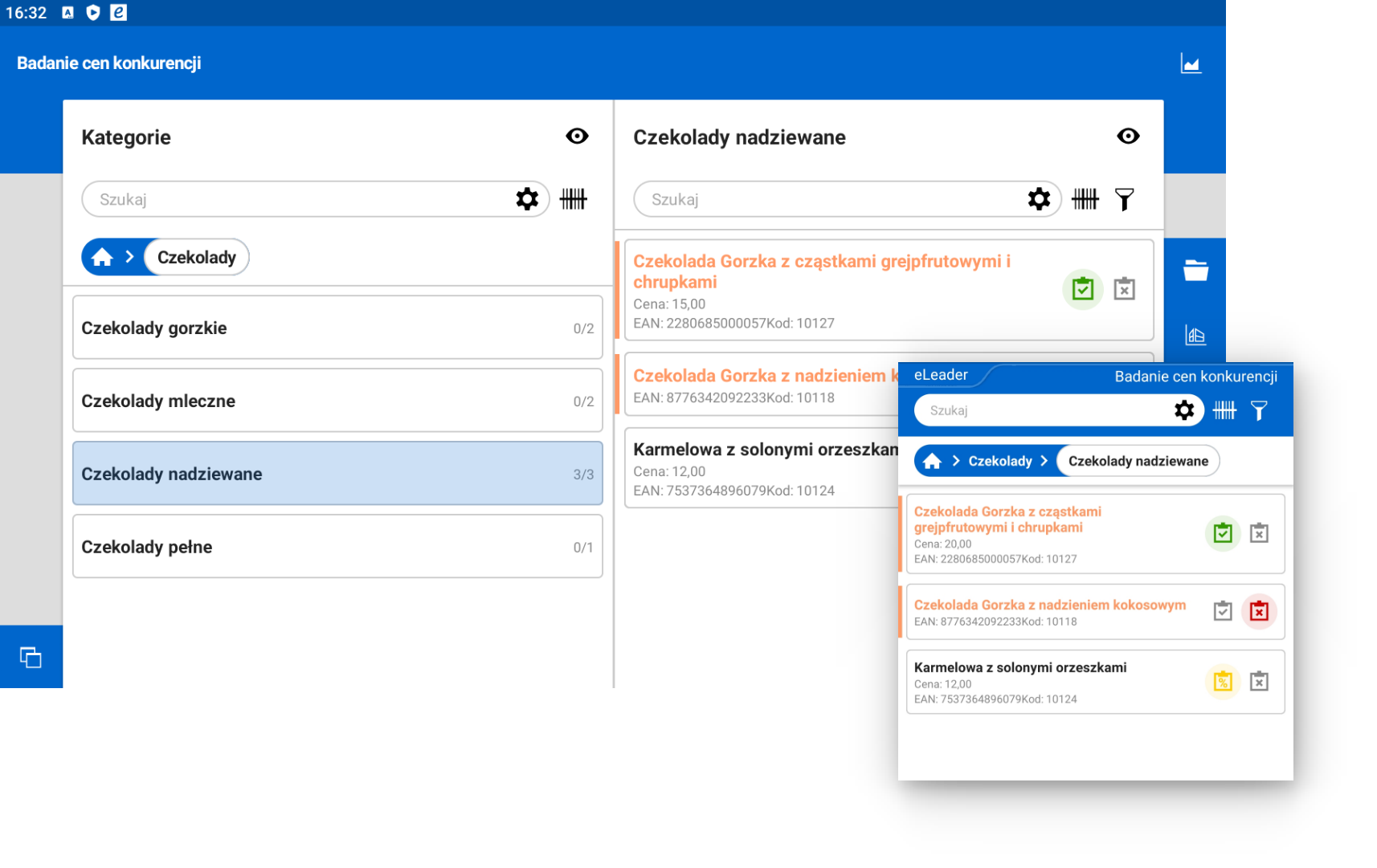

6. Surveys in the Work of a Sales Representative: Competitors Research

Competitors research surveys are tools for the analysis of the business environment and, more broadly, for market research. Almost all traders seek up-to-date information on competitors’ prices. This is done by manufacturers, distributors and retail chains alike. This can even lead to price wars. Competitive price research is therefore an intelligence tool in these wars. Some manufacturers conduct in-depth competitor research, including questions in the surveys about products, promotions, special displays, promotional materials or animation events.

7. Promotions Review Survey

From the consumer’s ‘front end’, promotions are usually simple situations. They may involve a price reduction, a stand or posters to encourage the purchase of multipacks. From the retailer’s “back-end”, they are usually complex activities that require the cooperation of marketing, logistics, category management, sales and, finally, the store itself. Breaking the chain of centralised promotion usually spells trouble. For example, a delay in product exposure compared to TV advertising results in both a lack of purchase and unmet consumer needs.

The salesforce application can help with this by using a Promotion Review Form. The form can be used to compare promotion data and information on its implementation in individual stores. In this way, the promotion manager will be better informed about the level and method of execution of the promotion. This information will also be useful in assessing the effectiveness of the promotion itself. When a quarter of the shops surveyed report a lack of promotional material or price signs, it may be that the failure of the campaign lies not in a bad concept but in poor execution.

8. Inventory of Equipment or POS Materials in the Store Survey

Ok, this may not sound like a typical survey that could be used for higher research purposes. However, it turns out that it is often more important to ask people about their opinions than it is to ask equipment about the presence and readiness for sales purposes. Equipment such as refrigerators, coffee machines, vending machines, freezers, special display racks or dispensers is a significant investment. Their correct allocation and maintenance in a good technical condition depends on information being obtained on a regular basis. An organisation in which a service engineer has to go to a refrigerator that is not in the store because it has been sent ‘offline’ to another facility is not going to look good. Therefore, salespeople and auditors must conduct occasional inventory checks, confirming the location and technical/visual condition of transferred equipment.

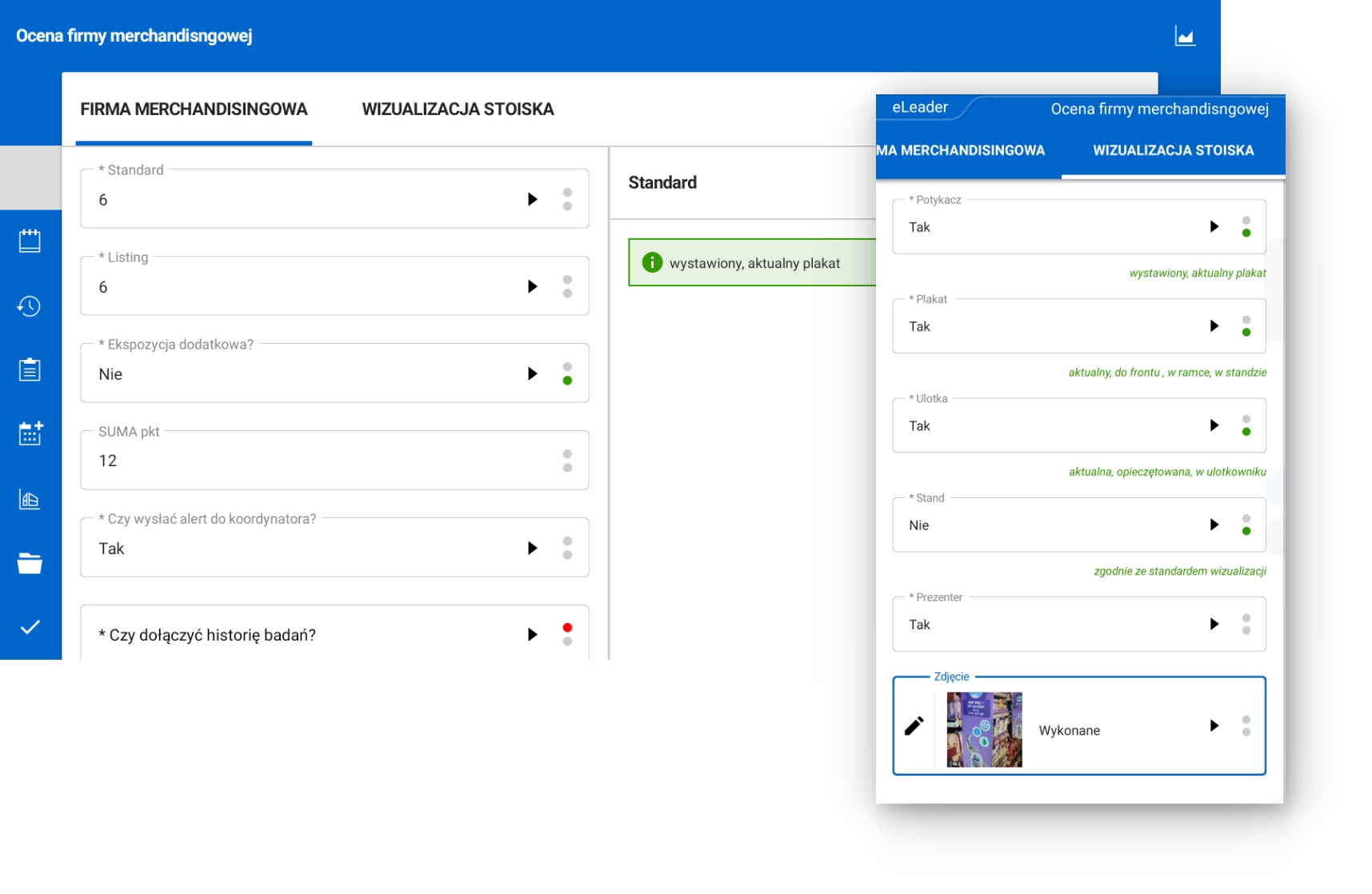

9. Surveys in the work of a sales representative for the assessment of merchandising companies

Promotional tasks or tasks related to the maintenance of product displays are often outsourced to merchandising or marketing agencies. There are a number of risks associated with working with external agencies in terms of the quality of the work performed. There are also problems with the proper implementation of standards or product knowledge among people who do not work for the contracting company. For this reason, auditors, often simply sales representatives responsible for a particular store, are required to conduct surveys on the quality of outsourced services. The evaluation of merchandising companies and outsourcing agencies is part of the evaluation of the cooperation, which can influence the decision to continue the cooperation or, in extreme cases, to apply contractual penalties. To give context to the answers, questionnaires can be supplemented with photographic documentation.

10. POS Materials Presence Assessment Survey

POS (Point of Sale) materials are items that support product sales in stores. From brochures, leaflets and posters to wobblers, scent or sound stands and hangers, anything that attracts attention and provides an extra incentive to buy falls into this category. As with equipment, POS materials usually represent a significant marketing investment and must be timed to coincide with promotional periods. If brochures are put out a week later, the chances of the promotion being successful are close to zero. As part of Sales Force Automation or Field Force Management applications, stores and auditors therefore need to monitor and report on the presence, currency and quality of in-store POS materials through surveys. The aggregation of data and its analysis in Business Intelligence applications provides insight into the quality of sales execution and suggests to marketing how to prepare and execute POS campaigns in the future.

11. Customer Training Needs Survey

A salesperson who can accurately advise consumers on solutions tailored to their needs is a real asset to them. They can also be valuable to your sales if they know how to operate and use what you have to offer. Whether you are dealing with an exclusive distributor, an authorized reseller or a regular shop selling your products, it is worth ensuring that the salesperson who is asked for advice by the consumer can say a few valuable words about your offering. In order to ensure the transfer of knowledge to the sales staff, it is worthwhile to do regular assessments of their needs in this area. Product knowledge and training needs surveys are excellent tools for monitoring the information gaps in your sales area. You can use this to organise training for customers, or fund a geographically localised course where it is needed the most.

12. Show and Presentation Needs Survey

Sometimes, to convince a customer to include your products in their range, you need to appeal to their imagination, their senses and to give them an example. Demonstrations, presentations of products in action (equipment, mixes, tools, etc.) are a great, but not cheap, way to activate business partners and build valuable cooperation. To ensure that it is worth organising a show or presentation, it is worth gathering information about the customer’s potential and the justification for the action (e.g. having competitors’ products in the offer or local conditions for holding the show). After the shows, you can conduct a survey that combines feedback from the presenter and the customer. In many situations, the workflow of the SFA application can anticipate the creation of an order on the spot.

13. Inventory Survey

Not everything in the store is visible at first glance. Even artificial intelligence cannot use a crystal ball to predict whether there is enough (or too much!) stock in the store’s warehouse. This in turn determines how the order is processed, whether it is recommended to put the goods on the shelf or to talk to the person responsible for stocking. An out-of-stock survey will help to determine whether out-of-stock problems are more widespread and whether they are related to store or distributor issues. The result of such a survey can also be an order, a notification or a report sent to, for example, the regional manager.

14. Evaluative Surveys in the Work of a Sales Representative

This time, let’s put the sales representative not in the role of the evaluator, but in the role of the one being evaluated. Evaluating a salesperson’s work where it is done, usually at the point of sale, helps to assess the level of compliance with working standards, product knowledge and personal culture. This is part of the wider issue of sales force management. Often, information on effectiveness is not enough to understand what might be causing unsatisfactory results. The perception of the representatives by the store staff and the feedback on punctuality, factuality and the ability to listen to the needs of the customers will help to identify the weak points of the sales visits and to start corrective processes.

The examples above are the most popular forms of gathering feedback. But remember that the essence of well-designed surveys is their suitability to specific needs and business situations. Therefore, the specific surveys in a salesperson’s work, the questions, the logic of the questions, the length of the questionnaires and the way they are analysed will depend on you.

Surveys in the Work of a Sales Representative – Use Them Wisely

Of course, it is worth remembering that survey research is not a remedy for all information shortages, and the quality of the knowledge obtained is not directly proportional to the number of questions and the frequency with which they are asked. Survey responses can be subject to bias and subjectivity (we write about some of these biases in this article). Nevertheless, the difference between even a small amount of reliable information and the absence of it is enormous and can be decisive in gaining an advantage over the competition. It can also help you to enter a market niche more efficiently than others.

In conclusion, valuable information is information that can be put to practical use. The time of sales representatives, consumers and business partners is limited, so if you choose to consume it, make sure that the information you obtain finds a place in appropriate reports and analyses. In this way, it will become a decision-making factor that will help you draw conclusions and take action, both on a day-to-day and strategic level.

Niche knowledge straight to your inbox!

If you find what you’re reading interesting, sign up for our newsletter to receive valuable articles straight to your email inbox.

Leave e-mail here: